What is the latest situation in the camp accommodation tax?

We examined the developments regarding the camp accommodation tax and the proposal for its complete abolition.

One of the most curious subjects of campers lately is the camping tax. The camp tax, which is thought to come into effect on January 1, 2023, included tents, caravans and bungalow accommodation in the taxes previously collected from hotels, hostels or small-scale holiday businesses. According to the news of Neşe Karanfil from Hürriyet, there has been a shocking development recently in the camp tax, which is thought to come into effect, and a law proposal was submitted by the Republican People's Party (CHP) Muğla Deputy Mürsel Alban to abolish the camp tax. For those who are wondering about the camp tax, we will first touch on the details of the "General Communiqué on Accommodation Tax Application" and then the news of the "Draft Law on Amendment to the Expense Tax Law".

Accommodation Tax Application General Communiqué

Where Will the Camp Accommodation Tax Be Applied?

Detailed information on how to apply the accommodation tax is included in the communiqué file of the Ministry of Treasury and Finance Revenue Administration. According to the content of the text, accommodation tax is expected to be collected from motels, holiday villages, hostels, hotels, apart hotels, thermal facilities, guesthouses, highland houses and similar facilities. In the critical part that concerns the campers, whether the accommodation belongs to the business or not, the tax will be collected from the accommodation in tents, tent-cars, caravans, motorhomes, bungalows and similar places.

When the wedding, cocktail, engagement, circumcision, meeting, congress, symposium and similar organization services, which are offered independently of the accommodation, are offered in a way to include accommodation, the organizations will not be subject to tax if detailed information is included in the invoice and a separate invoice is prepared for expenses. The tax in question can only be collected on accommodation services. In addition, according to the draft communiqué, even situations such as the early departure of the person staying at the facility will not affect the accommodation tax.

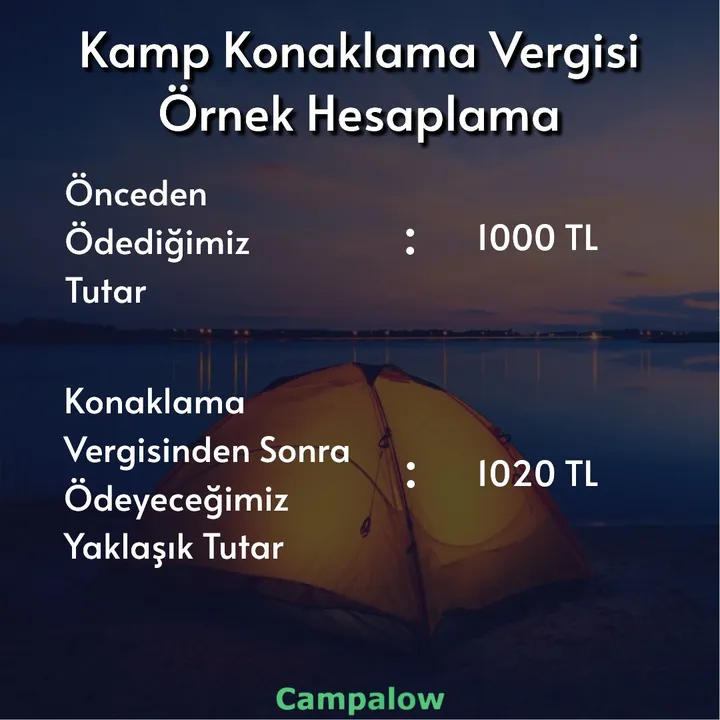

Camp Accommodation Tax Sample Calculation

If the amount we pay before the camping accommodation tax is 1000 TL, the amount we will pay after the base taxes will be around 1020 TL.

You can access the draft "Accommodation Tax Implementation General Communiqué" prepared by the Ministry of Treasury and Finance Revenue Administration via the link: https://www.turmob.org.tr/arsiv/mbs/resmigazete/-Kon_ver_gen_uyg_teb_taslak10102022.pdf

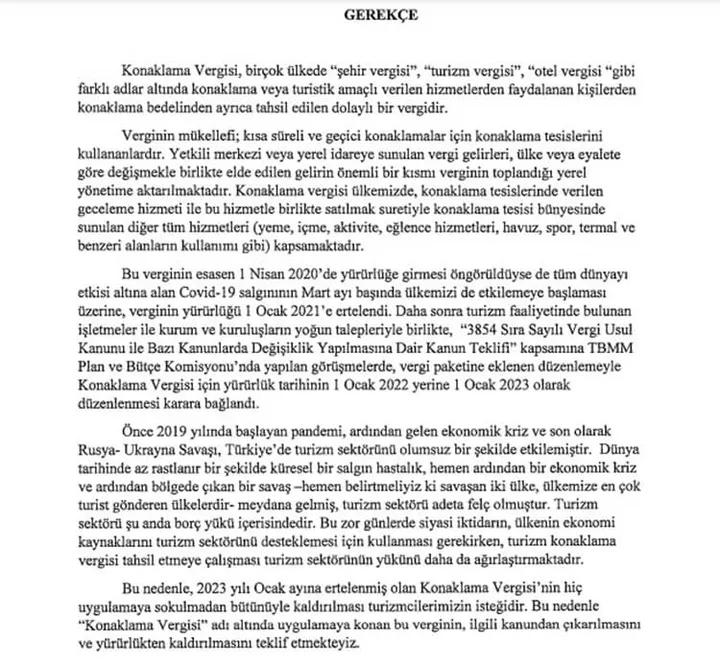

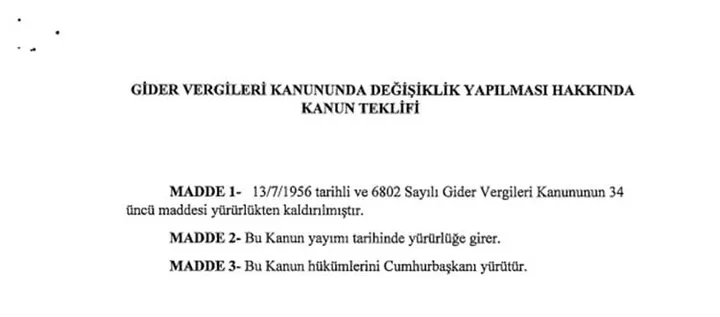

A Bill Has Been Submitted for the Complete Abolition of the Camp Tax

There are different developments every day in the controversial accommodation tax of recent times. A law proposal was submitted by the Republican People's Party (CHP) Muğla Deputy Mürsel Alban to completely abolish the accommodation tax, which was planned to be issued in 2019 but was planned to enter into force on January 1, 2023 with the changes made. Mürsel Alban, who made statements on the subject from his own office, gave the following statements:

“In this law, which was enacted under the name of accommodation tax, the Minister of Tourism, unfortunately, in the statement he gave to the press last year; announced that this tax has been postponed to January 1, 2023. As if a great job had been done, as if it were a great feat; He speaks with his chest as if the burden of the tourism operator has been taken away. I would like to address the Minister of Tourism from here. The tourism operator does not ask you to postpone it, not to postpone it, but to completely remove it.

We have submitted a law proposal to the Turkish Grand National Assembly (TBMM) regarding this issue. If he is sincere, I invite the Minister of Tourism to a study that will take the burden of tourism professionals and support them on the day our bill is discussed in the Parliament. If the Minister of Tourism is with the tourism professional, if he is sincere; Let's completely abolish this accommodation tax.”

The outcome of the "Accommodation Tax Implementation Communiqué" prepared by the Ministry of Treasury and Finance Revenue Administration and planned to enter into force on January 1, 2023, and the result of the law proposal given by the Republican People's Party (CHP) Muğla Deputy Mürsel Alban. You can follow our blog content to learn about the current developments in accommodation tax.